It’s been a while since I’ve written about eBay (EBAY). My previous articles have been very bullish on the prospects of eBay. Since those articles, eBay dipped to a low March 9th low of $9.91, but has since enjoyed a tremendous rally and more then doubled to settle at yesterday’s closing price of $20.37.

I wanted to review yesterday’s quarterly report in the context of this rally and assess the condition of the patient. (See Q2 conference call transcript here.)

Doctor, We’re Losing Him

During the last 3 quarters, eBay was basically on life support. Its core marketplaces were not only contracting, but many people were also questioning the other core components; namely PayPal and Skype. I argued that while the pessimism was warranted, the poorly performing marketplace was effectively already priced in the low stock price.

I argued that PayPal and Skype were still incredible businesses and that while the marketplace was suffering growth concerns, investing in eBay would still be prudent on the merits of PayPal and Skype alone.

Regardless of how valuable PayPal and Skype are, I’m happy to report that yesterday’s quarterly earnings announcement has probably given a collective sigh of relief to many of eBay’s investors.

We’ve Stabilized the Patient

A look at core marketplaces shows the most promising development for eBay this quarter – eBay’s executive team has finally been able to stem the bleeding. Quarterly sequential growth for marketplaces has finally increased for the first time in 5 quarters.

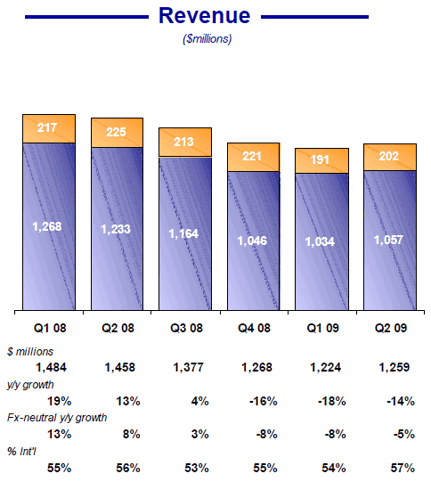

MARKETPLACE REVENUE

Marketplaces generated 1.259 billion in revenue for the quarter. While it still represents a 14% decrease in year-over-year revenue, it does represent real sequential growth quarter to quarter. The most important factor here to consider is they’ve stopped the contraction, and even squeezed out growth in this terrible climate – no small feat. This is a good first step.

eBay’s marketplace is not out of the woods yet; with increasing competition from Amazon (AMZN) and independent resellers; eBay has many enemies. I do believe that John Donahoe feels the fire under him, and nothing helps a business improve more than healthy competition.

In the last two years, eBay has introduced a myriad of controversial and often draconian measures (mainly toward sellers) aimed at making the marketplace safer and more trusted. It was radical and swift, to say it alienated many buyers would be an understatement.

However, a positive effect was eBay has lowered fraud rates and increased customer satisfaction. This has been John Donahoe’s strategy all along, to make the buyers king.

Whether the wisdom of "customer is always right" eventually pays off is yet to be seen, however if yesterday’s results are any indication of returning customers, Donahoe’s radical changes may finally be starting to pay off.

What’s the Prescription Now?

Now that eBay appears to have found a bottom, I would encourage Donahoe and team to now re-engage the sellers. The plethora of angry, distraught, and hostile ex-sellers are ubiquitous on any web forum about eBay (you’ll find many eBay haters commenting on this article I assure you). I believe a lot of the negative sentiment was aggravated by eBay’s own actions. The speed, magnitude, and inflexibility of the changes created a lot of disgruntled sellers. I believe a re-engagement of sellers should be the second part strategy of re-inventing eBay.

The New Crown Jewel

I’ve stressed in the past that PayPal has largely been ignored under the eBay umbrella of brands. I hope yesterday’s earnings will prove beyond any doubt the power of this business.

PAYPAL REVENUE

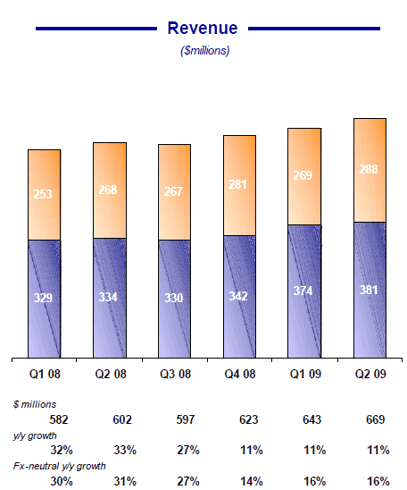

In this tough business environment, PayPal continues to fatten and lay ever bigger golden eggs for eBay.

Growing 4% quarterly and 11% annually is impressive in this challenging environment. PayPal continues to expand market share, leaving competitors like Google Payments (GOOG) in the dust. The strategic acquisition of Bill Me Later I believe, will eventually pay dividends as it becomes a more widely accepted form of credit (especially in the credit crunched market we are in)

PayPal has no signs of slowing down any time soon, and if they can perform this well in this environment, imagine how they will do if and when the economy rebounds.

Diamond in the Rough

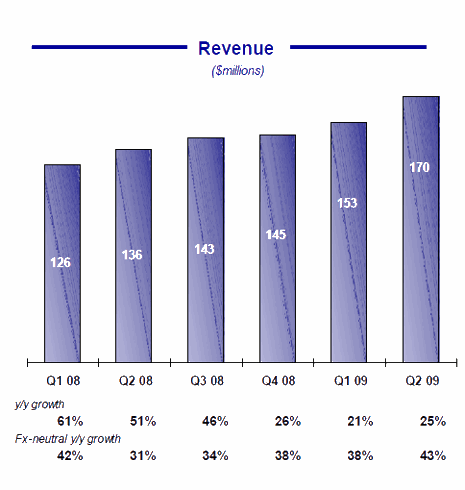

Now we come to Skype. The unwanted step child that everybody likes to rag on. Already slated for an IPO, Donohoe has finally decided to try and toss this albatross off eBay’s neck. One would think that Skype is not profitable and contracting.

But yesterday’s results have reinforced what I’ve been saying now for a long time…Skype is a good business. 11% quarterly sequential growth and 25% year over year growth – In this environment is nothing short of remarkable. Given current trajectory, Skype is conservatively estimated to book 700 million in revenue for 2009. Based on comments made in the past, we would expect a net gross profit around 100 million.

Again, nothing astronomical but any business that is growing and profitable in this climate should not be ignored. Google realizes this, that is why they’ve launched their direct competitor to Skype: Google Voice.

SKYPE REVENUE

What Lies Ahead for eBay?

eBay spends millions of dollars a month at Google in adwords. I’ve written a controversial post arguing that Google should have seized the moment and acquired eBay during the doldrums of the financial crisis. I still believe eBay is a natural fit. Google wants to be in the payments and voice business.

As for marketplaces, it is true that it is completely tangental to Google’s search business, however, this is exactly the reason why Google should acquire it….to expand from their one-trick-pony of adwords.

Naturally marketing eBay’s listings would yield automatic cost savings and increased marketplace activity. Even if eBay is a dying business model, as I’ve argued - the stock price has effectively priced it out – and Google would simply be buying Skype and PayPal, while getting eBay for free.

With the stock price almost doubling in the last quarter, the value proposition is no longer there, but I still think that Google acquiring eBay would create a blank slate on all the negative seller sentiment – with an introduction of clear and polices that are no longer a surprise to sellers. This coupled with the search engine technology and natural keyword/adword placement would cement Google as the preeminent place to search for all things retail and how to pay for them as well.

No comments:

Post a Comment