What lies in store for this dot.com bellwether? Well, let’s take a look at where we’ve been, where we’re at, and hopefully where I think we’ll be by Wednesday.

First, let me give you a chart with quarterly revenue since eBay (EBAY) went public.

It displays revenue by quarter. It also has quarter over quarter growth (QoQ) and year over year growth (YoY).

Revenue History & Growth |

|

| |

Quarter | Revenue | QoQ | YoY |

QTR 1 2001A | $ 154,090 | 15.00% |

|

QTR 2 2001A | $ 180,905 | 17.40% |

|

QTR 3 2001A | $ 194,425 | 7.50% |

|

QTR 4 2001A | $ 219,401 | 12.80% | 64% |

QTR 1 2002A | $ 245,106 | 11.70% | 59% |

QTR 2 2002A | $ 266,287 | 8.60% | 47% |

QTR 3 2002A | $ 288,779 | 8.40% | 49% |

QTR 4 2002A | $ 413,928 | 43.30% | 89% |

QTR 1 2003A | $ 476,492 | 15.10% | 94% |

QTR 2 2003A | $ 509,269 | 6.90% | 91% |

QTR 3 2003A | $ 530,942 | 4.30% | 84% |

QTR 4 2003A | $ 648,393 | 22.10% | 57% |

QTR 1 2004A | $ 756,239 | 16.60% | 59% |

QTR 2 2004A | $ 773,412 | 2.30% | 52% |

QTR 3 2004A | $ 805,876 | 4.20% | 52% |

QTR 4 2004A | $ 935,782 | 16.12% | 44% |

QTR 1 2005A | $ 1,032,000 | 10.28% | 36% |

QTR 2 2005A | $ 1,086,000 | 5.23% | 40% |

QTR 3 2005A | $ 1,106,000 | 4.00% | 37% |

QTR 4 2005A | $ 1,329,000 | 20.16% | 42% |

QTR 1 2006A | $ 1,390,419 | 4.62% | 35% |

QTR 2 2006A | $ 1,410,784 | 1.46% | 30% |

QTR 3 2006A | $ 1,448,637 | 2.68% | 31% |

QTR 4 2006A | $ 1,719,901 | 18.73% | 29% |

QTR 1 2007A | $ 1,768,074 | 2.80% | 27% |

QTR 2 2007A | $ 1,834,429 | 3.75% | 30% |

QTR 3 2007A | $ 1,889,220 | 2.99% | 30% |

QTR 4 2007A | $ 2,180,606 | 15.42% | 27% |

QTR 1 2008A | $ 2,192,223 | 0.53% | 24% |

QTR 2 2008A | $ 2,195,661 | 0.16% | 20% |

QTR 3 2008A | $ 2,117,531 | -3.56% | 12% |

QTR 4 2008A | $ 2,035,846 | -3.86% | -7% |

QTR 1 2009A | $ 2,046,636 | 0.53% | -7% |

QTR 2 2009A | $ 2,097,992 | 2.51% | -4% |

QTR 3 2009A | $ 2,237,852 | 6.67% | 6% |

QTR 4 2009A | $ 2,370,932 | 5.95% | 16% |

Payment Revenue

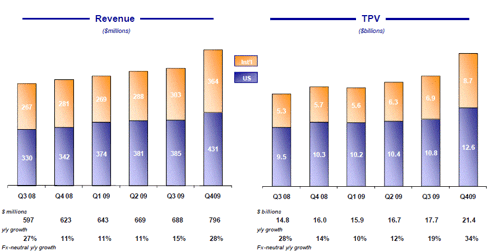

PayPal booked 795 MM in revenue in Q4 2009. With activity and listings increasing - and I don’t mind going out on a limb here - I am forecasting a 3% revenue increase from Q4. This is in line with historical growth rates. I expect revenue for PayPal to come in around 819 MM.

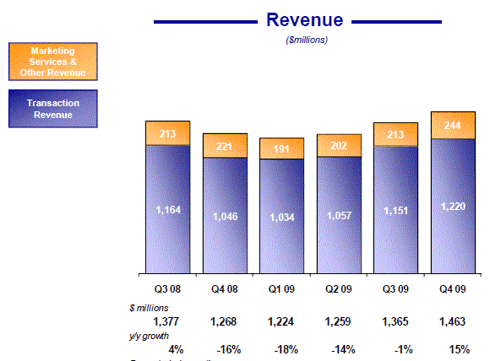

MarketPlaces

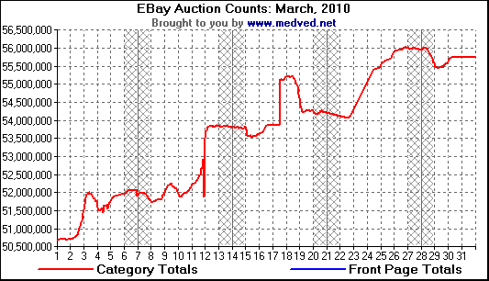

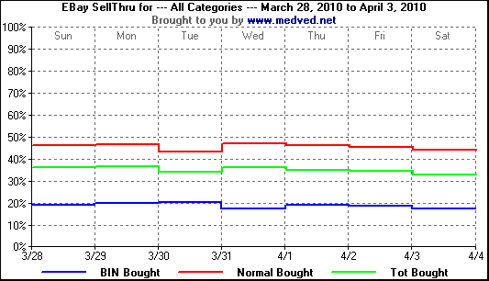

With added auctions, stable sell through rates and increasing consumer confidence, eBay’s MarketPlace business seems to have found its footing. It is this segment that is the biggest (and most difficult) to forecast. eBay has essentially assumed a retrench to below Q3 revenue. Based on what I’ve seen from auction listing rates and sell through rates (see the chart below), I think we’re in for another strong quarter that will exceed eBay’s estimates. Strong listings combined should counteract reduced take rates. I believe eBay will exceed its own published forecast . I’m estimating revenue at 1.38 billion for MarketPlaces.

eBay’s Sell Thru has been roughly in the high 30 percent range in Q4, 2009. This trend continues with a slight dip in March 2010.

Communications

Skype contributed 138 million in Q1 2009; if current trajectories have held, it should have contributed gross of around 185 million this quarter. However, eBay now only owns roughly 1/3, so keep that in mind with their revenue release a net revenue contribution of 61 million would be about in-line.

Currency Fluctuations

With half of eBay’s revenues coming from international markets, currency rates have a huge impact on revenue. The dollar gained some strength in the first quarter of this year versus the euro – around 6 percent. I would give eBay’s earnings a boost of around one percent due to currency exchange rates.

***

eBay has given 2.1 to 2.2 billion in revenue guidance from the last earnings (Q4) report. I forecast that total eBay revenue will come in at 2.3 billion with eps of 0.33 cents (GAAP) and .43 cents (non-GAAP).