Turning the Titanic

eBay is not shy of controversy. From upsetting long time sellers, to having to delist inappropriate auctions, eBay seems to stir up the bee’s nest like no other dot com. A couple years ago, Meg Whitman, the long time CEO, handed the wheel to John Donahoe who was inheriting a rapidly slowing auction business. The new CEO quickly went to work implementing radical changes to the marketplace, and angering sellers along the way.

eBay had finally matured and Donahoe solidified the inevitable, turning eBay from a community-based startup to full fledged public corporate American company (that ultimately answers to shareholders.) The timing couldn’t have been worse, the radical changes occurred simultaneously with what seemed to be crumbling of the American financial system. The changes were further exasperated by the false assertion that eBay just bought the dead dog Skype.

It wasn’t until the second quarter of 2009 that eBay’s numbers started seeing the fruits of Donahoe's strategy. Q2 2009 was the first quarter with growth in almost a year seemed to initially validate Donahoe changes. The third quarter further solidified that John Donahoe’s makeover strategy was working. And with today’s quarterly earnings announcement, I think there should no longer be any doubt that there was a method to King Donahoe’s madness.

One more step toward that cashless society

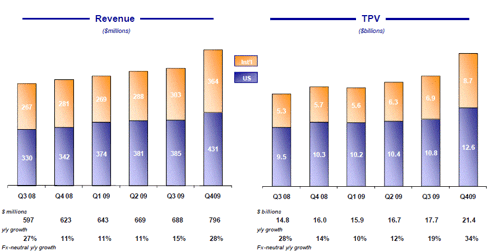

If you don’t know that eBay has repositioned PayPal as its new flagship business unit, you do now. I’ve even joked that eBay might as well change their stock ticker to PYPL. PayPal’s growth and profits have continued to skyrocket. Amid what analysts considered would be a modest retail season, PayPal accelerated growth and further gained market share (when was the last time you used “Google Payments”?). An amazing 28% year over year growth and a very robust 34% growth in Total Payment Volume (TPV).

Bill Me Later’s also ended the year with 320 million accounts (almost 50% over last year)

PayPal Revenue (Click to enlarge)

PayPal is without a doubt the main driver of growth for eBay and will continue to be so. As a standalone business, PayPal has tremendous potential, and many investors simply do not realize that the realignment of eBay has already occured with PayPal truly being the 'mother company.'

Core Marketplaces

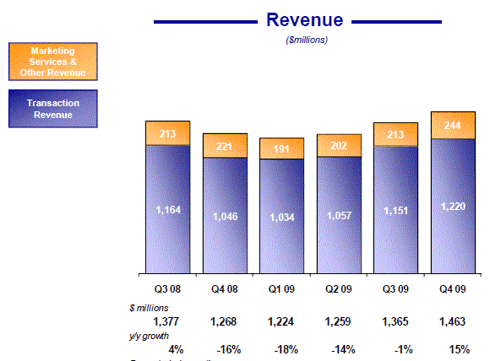

Now we come to the crux of eBay’s drama – the Mainstay site. Is John Donahoe plan working? Well what does this chart tell you?

Marketplace Revenue

Marketplaces generated $1.463 billion in revenue for the quarter. Most importantly, this is the first sign of growth in a year. If that’s not a turnaround, what is? eBay has finally stopped the contraction and squeezed out growth 3 quarters in a row now.

In these challenging times, eBay may have revealed its counter cyclical resilience. As more and more people are stretched financially, they are turning to the secondary market to purchase discounted items and sell unneeded items.

So Long, Farewell Skype

The ink is dry now and eBay is $1.9 Billion richer. (eBay now has a $5.2 billion war chest and minimal debt) More importantly, it was able to take the unwarranted bad press of their backs. Meg and eBay gave their best efforts to integrate Skype to eBay, but it became obvious that Skype was just too tangential to eBay. I plead to any rational mind however, that while yes, eBay did make a mistake in buying Skype – it was not a fatal one, not even a flesh wound. Today’s results have illustrated once again why somebody would buy Skype from eBay. While only releasing partial numbers, Skype shows that it continues to grow, be profitable, and most important continue to add to eBay’s bottom line with their retained 1/3 stake.

What lies ahead?

eBay always gives conservative forecasts, and this quarter is the first time I’ve seen a somewhat “bold” forecast. Last quarter they said 4th quarter would basically be flat. (Talk about under promising and over delivering.)

eBay expects 2010 to deliver $1.63 to $1.68 a share, with revenue coming in between $8.8 billion and $9.1 bill This is higher then what analysts were expecting of $1.60 a share on revenue of $9 billion.

It seems Donahoe may know something we don’t as the formerly cautious CEO seems to feel that tailwinds may finally be blowing

Disclosure: Author holds a long position in EBAY.

No comments:

Post a Comment