I’ve written before about the amazing potential of one of the most maligned and misunderstood acquisitions in my recent memory. eBay’s (EBAY) purchase of Skype has been unanimously decried with such words as “irrational” and “foolish.”

With such negativity, one must assume Skype is a dying, unprofitable, debt laden business!

The Little Engine that Could

Malcom Gladwell is a widely read anthropologist with a popular series of books about the sociology of business and talent. One such book, The Tipping Point talks about those great paradigm shifts that disruptive technologies have created through history. Gladwell specifically targets that magical moment where an idea/product reaches a point of no return; where the positive feedback of user adoption creates a virtuous upward cycle that is unstoppable (hence the title of the book.) Is Skype reaching that point?

An interesting thing is happening to Skype user rates that seem to be hardly reported.

One often ignored metric that many analysts glance over is the concurrent user number. This number represents the total number of users that are actively on the Skype network. I argue this metric is one of the most important metrics when analyzing Skype; as it represents “real’ user adoption. Forget about user accounts registered (a user can register more then once or not even use it) – the real number you should be looking at is what number of users are actually logged in and USING Skype at the same time.

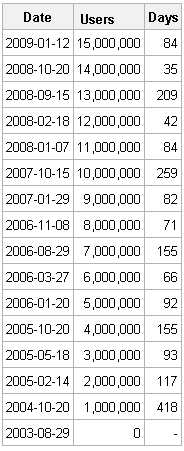

This graph shows the million milestones of concurrent users and the number of days it took to reach each consecutive million concurrent user rate.

On 1-26-2009 – Skype had a record 15,952,085 users. That’s almost an additional 1 million users since the last million milestone of 1-12-2009 – This is a record pace – only 16 days! At this trajectory – Skype is not only growing, but accelerating growth.

You can always track the current user log in rates in this helpful site (Source: Borderless Communicator).

Show Me The Money!

Ultimately, I do understand that user rates aren’t worth a bucket of beans if it doesn’t translate to revenue.

Skype Year End Revenues

- 2007 Revenue: 382 Million

- 2008 Revenue: 551 Million

This represents a healthy 44% Year over Year growth.

Assuming that the revenue declaration continues at its current pace and Skype grows revenues at 33% Year over Year for 2009, this would yield 2009 pro-forma operating income of $117 million and tax-adjusted pro-forma earnings of approximately $108 million. Skype's operating margin (excluding options) is expected to come closer to 16% in 2009. Again, just being very conservative and a forward P/E multiple of 30x (again restricting PEG to 1.0x) we get a current valuation of roughly $3.2 billion. 3.2 Billion Is more than the 3.13 Billion dollars that eBay paid and definitely more than what eBay has valued Skype at 2.23 B.

I concede to Skype’s detractors that Skype revenue is slowing due to the natural effect of having free calls as more and more Skype users can talk free to fellow Skype users as more of their friends join. However, I’m not concerned about this as much as I am excited about what I believe to be the next paradigm shift that will ultimately take Skype to the moon.

VOIP’s time may finally come

I mentioned previously that Gladwell's book The Tipping Point was all about that moment where an idea or technology reaches critical mass where there is no point of return. Gladwell’s book discusses many instances where for whatever reason, a technology sometimes take a while to catch on. Take texting for example, mainstream in Asia for years before the first teenager got sore thumbs broadcasting his or her life on Twitter. There is now a plethora of VOIP offerings, the most high profile disappointing offering being Vonage (VG).

I argue that the wild card is cell phone apps. Skype already has an application on Google’s (GOOG) Android OS and is soon to complete one for the iPhone.

For those not too savvy about what this means, well it entails very cheap domestic / international calling regardless of how many minutes you have on a phone plan (as long as you have an internet connection like the iPhone). I’ve been using the former applet on my cell phone to call internationally, and I’ve found no easier way for me to call the world cheaply on my cell phone than Skype. I believe the future of mobile devices will slowly move from a ‘per minute’ model to a flat rate model that includes voice and data. Think of this shift as like the early days of the internet (i.e. AOL) where you had to dial up and pay “per minute.” Eventually the ‘per minute’ model changed to a monthly flat rate fee. Many of the wireless providers already provide ‘unlimited’ minutes for a flat fee. With iPhone monthly user fees nearing $100 – the spread between the cost of unlimited minutes and a variable monthly fee is getting thinner and thinner.

As users demand more ubiquitous internet access, to me it’s a no brainer that it’s a matter of time until a data connection becomes an “always on” proposition. This shift is further bolstered by the launch of “netbooks” (micro laptops that stress mobile internet connections). While unlimited minutes would ultimately depress Skype’s advantage for domestic calls (something that Skype was never used much for) – it would only amplify the value proposition for Skype’s main attraction: international communication. If my predictions for unlimited minutes never happens, Skype would benefit even more; by allowing users to circumvent their ‘minutes limit” for domestic calls and the international benefit still remains. I argue this demand will only grow as the world becomes more and more integrated and mobile devices continue to grow. Skype is right there ready to fill gaps from continued shift to mobile communications (on and off the desktop

A Diamond in the Rough

I believe Skype presents a tremendous opportunity, and has been so badly tarnished by its parent's (eBay’s) troubles that people are ready to throw eBay’s baby out with the bathwater. Whether eBay ultimately sells Skype or hangs on to it, it’s a great asset that is ignored by and large by the investing community and I hope this article brings to light the enormous opportunity of becoming the de facto standard of voice communications that Skype presents.