To Recap: Last quarter eBay begun to see glimmers of hope with its business. They had their first quarter over quarter growth in 6 months and seemed to be reversing the trend of contracting overall revenues. Many investors were biting their nails today to see if that was just an anomaly or if John Donahoe’s turnaround strategy was working. Today’s quarterly earnings announcement shows that while there is a long way to go, eBay has definitely turned around.

business. They had their first quarter over quarter growth in 6 months and seemed to be reversing the trend of contracting overall revenues. Many investors were biting their nails today to see if that was just an anomaly or if John Donahoe’s turnaround strategy was working. Today’s quarterly earnings announcement shows that while there is a long way to go, eBay has definitely turned around.

business. They had their first quarter over quarter growth in 6 months and seemed to be reversing the trend of contracting overall revenues. Many investors were biting their nails today to see if that was just an anomaly or if John Donahoe’s turnaround strategy was working. Today’s quarterly earnings announcement shows that while there is a long way to go, eBay has definitely turned around.

business. They had their first quarter over quarter growth in 6 months and seemed to be reversing the trend of contracting overall revenues. Many investors were biting their nails today to see if that was just an anomaly or if John Donahoe’s turnaround strategy was working. Today’s quarterly earnings announcement shows that while there is a long way to go, eBay has definitely turned around.The new standard bearer:

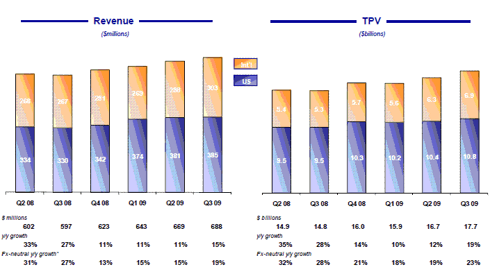

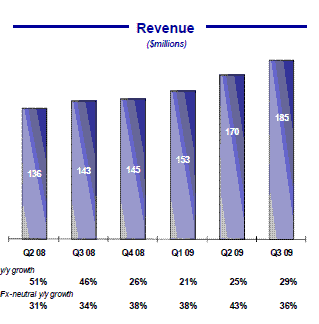

A lot of people have missed that eBay has repositioned PayPal as their new flagship business unit. eBay might as well change their stock ticker back to PYPL to more accurately illustrate this. Once again, Paypal’s growth and profits were stellar. Even during the deepest darkest pits of the financial crisis and recession, PayPal continued to not only deliver but gain market share. 15% growth (19% if you take into account the weak dollar) and 19% (23% again if you take into account exchange rates) of Total Payment Volume (TPV) are numbers any large cap would die for. Bill Me Later’s integration with PayPal and eBay should also help the top and bottom line in the future. eBay’s not stopping here either, in today’s earnings call, eBay expressed it’s plans to DOUBLE PayPal’s business by 2011. That’s 5.5 billion in revenue. That's a tall order, but if PayPal is performing this well in this economy, if/when the economy picks up - PayPal will be well positioned to deliver.

PAYPAL REVENUE

Core Marketplaces

This is where eBay has been hurting most, marketplaces is where the trouble started and still continues to be a challenge. Donahoe’s new strategy however seems to be working (however slowly.)

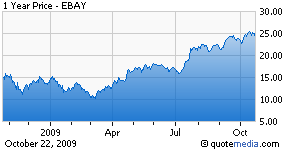

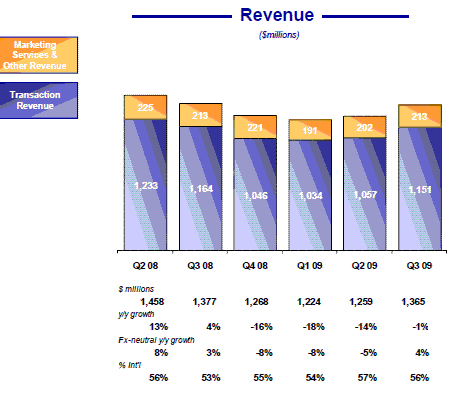

MARKETPLACE REVENUE

Marketplaces generated 1.365 billion in revenue for the quarter. While it still represents a 1% decrease in year-over-year revenue, it does represent the second quarter of real sequential growth quarter to quarter. The most important factor here to consider is they’ve stopped the contraction, and squeezed out growth 2 quarters in a row now.

Skype it to me.

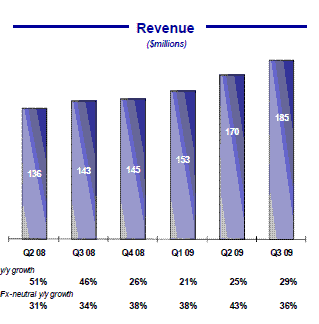

The news that Skype was sold for a value of 2.7 Billion was welcome news to many eBay investors. It has become obvious that it is tangential to eBay’s business. However, today’s results have illustrated why somebody would buy Skype in the first place. Skype is a good business. 8% quarterly sequential growth and 29% year over year growth are very healthy numbers. Given current trajectory, Skype is conservatively estimated to book 700 million in revenue for 2009. Based on comments made in the past, we would expect a net gross profit around 100 million. These are respective numbers, and with growth still solid – Skype should prove to be a boon to eBay in the future with their 1/3 stake.

SKYPE REVENUE

Sour Christmas Forecast

eBay gave a very conservative forecast for their 4th quarter – basically a flat outlook. eBay is known for giving very conservative forecasts, and today’s future estimate is no exception. I believe the reason for this is Donahoe knows there are still very powerful headwinds blowing against eBay. There is increased competition, the weak dollar, and no guarantee his new policies will continue to work. Marketplaces are at a crucial point, even with growth from PayPal. In order for eBay to really start firing on all cylinders, they need to reignite marketplaces.